Posted by: Staff

February 21, 2023

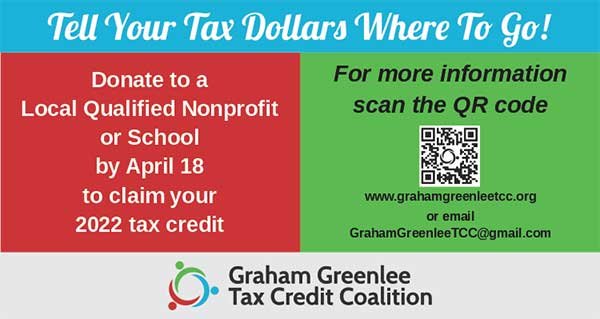

The Graham Greenlee Tax Credit Coalition is a community of local nonprofits and local schools that promotes $1 Arizona income tax credits given to those who donate to eligible organizations and schools. Coalition non-profits are made up of hard-working businesses that provide immediate basic needs to low-income families and locals with needy children. This year’s members are Boys and Girls Club of Gira Valley, Duncan and Clifton Food Bank, Graham County Rehabilitation Center, Neighbors Farm & Pantry, SEACUS and Tooth Bud.

You can keep your dollars local by receiving this dollar-for-dollar tax credit on your Arizona income tax return. Local schools are also participating in this awareness campaign. Your donation will work immediately in your community and provide support to eligible organizations and schools of your choice. Donations made by April 15 are eligible for a tax credit of $1 per dollar against taxes payable on your 2022 Arizona income tax return. For more information on the federation, please visit: www.ggtcc.org or Facebook page www.facebook.com/grahamgreenleetcc.

The Graham Greenlee Tax Credit Coalition generously supports many local businesses and organizations, including the United Way of Graham & Greenlee County, FMI, Vining Funeral Home, AshCreek Financial, Luke and Teonna Hoopes with Edward Jones, Smith and Taylor Automotive, Farmers and more I am grateful to Insurance, Farm Bureau Insurance, City of Safford, Town of Thatcher, Graham Chamber of Commerce, Safford, Thatcher, Pima Unified School District and many others.