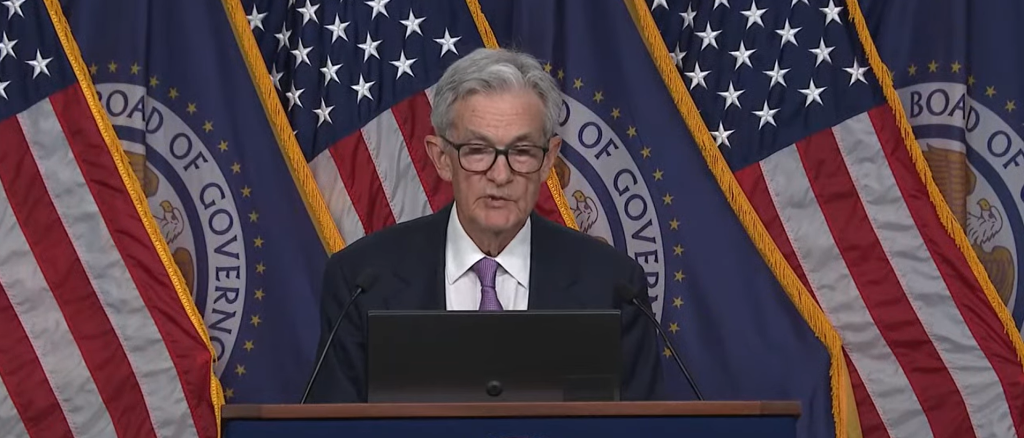

Federal Reserve Chairman Jerome Powell suggested at a press conference on Wednesday that immigration is fueling rising unemployment.

Powell spoke to reporters after the Fed announced it would cut the federal funds rate by 0.50 percentage point after disappointing job gains in July and August. The unemployment rate is now at 4.2%. 3.4% April 2023 — Powell suggested this was mainly due to migrants crossing into the US. (Related article: Democratic senators call for big interest rate cuts as Election Day approaches)

“There has been a fair amount of cross-border influx and that's actually one of the factors that has led to the higher unemployment rate,” Powell told reporters at a news conference.

🚨 Federal Reserve Chairman Jerome Powell said the massive influx of illegal immigrants under Kamala's administration has caused the unemployment rate to rise, saying, “There's been a significant influx across the border, and that's actually one of the factors that's caused the unemployment rate to rise.” pic.twitter.com/7jaJDRzpdk

— Trump War Room (@TrumpWarRoom) September 18, 2024

Over 10 million Immigration The Washington Examiner reported in October 2023 that more than 500,000 Cuban, Haitian, Nicaraguan and Venezuelan migrants have crossed the border illegally since President Joe Biden took office in January 2021. Under an effort launched by the Biden-Harris administration, more than 500,000 Cuban, Haitian, Nicaraguan and Venezuelan migrants have flown into the country and been granted parole.

The influx of immigrants has overwhelmed cities such as Springfield, Ohio, where median rental prices soared by more than 40% in September compared to 2023 prices following the arrival of more than 15,000 Haitian migrants.

Rising unemployment rates have intensified fears of a recession in recent months, leading to selling pressures on global stock markets in early August, with Tokyo's Nikkei stock average falling 12.4% in one day, its worst one-day drop since the 1987 “Black Monday” crash. According to The US S&P 500 also fell under selling pressure, dropping about 3%, its biggest drop since late 2022, according to the Financial Times.

Lowering interest rates could lower the cost of capital, freeing up capital for both businesses and consumers and boosting gross domestic product (GDP). Expectations of faster GDP growth could also boost stock markets, as they did when the Fed signaled interest rate cuts in December 2023. reduce This year's interest rate is assistance Harris's election chances.

The strong performance of the S&P 500 Index in the three months leading up to an election has accurately predicted the likelihood of the incumbent party winning the presidential election 83% of the time since 1928. More than 80% of registered voters say The economy will play a big role in which candidate is chosen in 2024.

In addition to rising unemployment, Wednesday's rate cut came amid a slowdown in inflation, which fell from 9.1% in June 2022 to 2.5% in August, just half a percentage point below the Fed's 2% target rate. But much of the damage from the inflation peak during the Biden administration is still being felt, with prices rising more than 20% since he took office in January 2021.

Inflation was just 1.4% at the end of former President Donald Trump's term, when he nominated Powell to be Fed chair in November 2017. According to “I think he's a very good man,” he told the BBC in 2023, but later became more critical of him and insisted he would not reappoint him if elected.

“I'm not going to reappoint him. I thought he was always going to be late, for better or worse, and he was always going to be late,” Trump told Fox Business' Larry Kudlow on Aug. 17. “I was surprised he was reappointed. I think he was reappointed because they knew I didn't like him very much.”

The Federal Reserve did not immediately respond to a request for comment.

All content produced by the Daily Caller News Foundation, an independent, nonpartisan news service, is available free of charge to any legitimate news publisher with a large readership. All republished articles must include our logo, reporter byline, and affiliation with the DCNF. If you have any questions about our guidelines or partnering with us, please contact us at licensing@dailycallernewsfoundation.org.