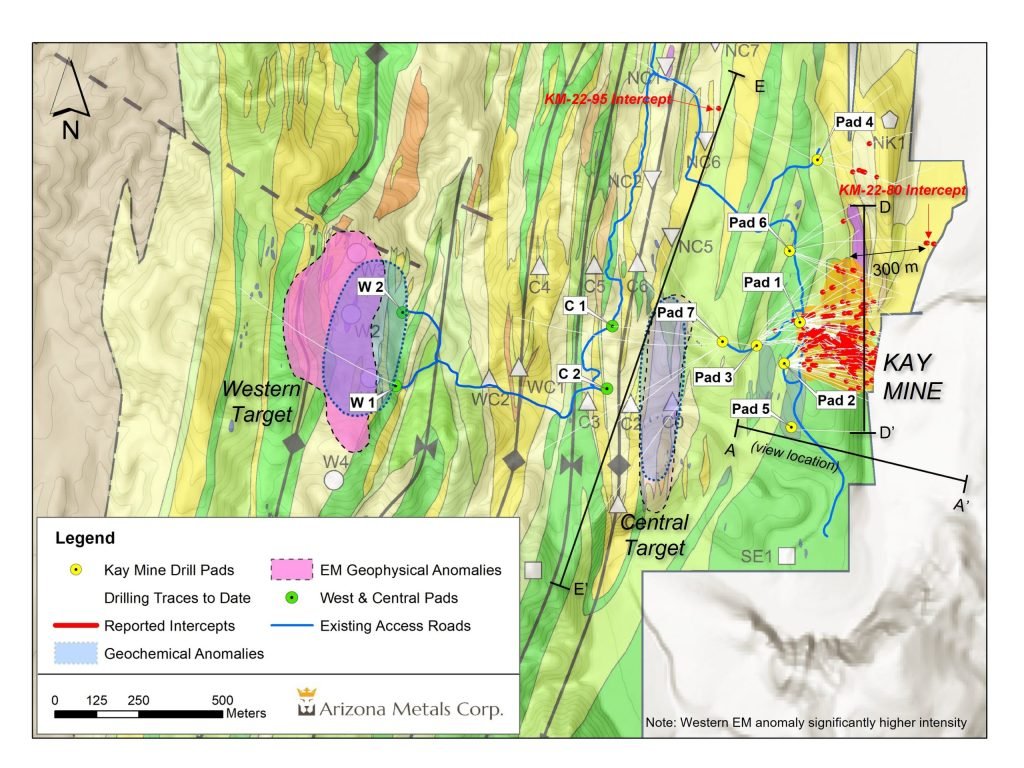

Arizona Metals (TSX:AMC) announced the new discovery of copper-gold-zinc VMS mineralization in the Kay Mine deposit in Arizona. The company’s step-out exploration drilling intersected a potential new mineralization zone located 600 m north and along the strike of the central target EM anomaly. Hole KM-22-95 was intersected with 2.7 m grading 0.5% CuEq at a vertical depth of approximately 320 m. The discovery of clusters of large-scale sulfide mineralization during this time indicates proximity to primary large-scale sulfide mineralization. Follow-up drilling is planned to test the extension of mineralization encountered at this hole.

The company also reports that extended drilling at the northern end of the silica mine deposit has extended mineralization to 100 m north of hole KM-22-71A. Hole KM-23-97 intersects 8.8 m of 4.8% CuEq, confirming vertical continuity of high mineralization at 160 m between holes KM-20-11 and KM-21-19. bottom.

Arizona Metals reported six additional hole results from the Kay Mine deposit, including both fill holes and extension holes.

The company will begin drilling at the Western Target in February 2023, with the first hole, KM-23-104, currently underway. The hole is drilled approximately 650 m west of pad W1 to a vertical depth of 700 m below the surface. Upon completion, downhole electromagnetic surveys will be conducted to test the conductor extensions previously observed in both helicopter and ground loop electromagnetic tests.

With $53 million in cash as of December 31, 2022, Arizona Metals has sufficient funding to complete its Phase 2 program (budgeted at $1.6 million) at Kay Mine Deposit. The company plans to drill an additional 76,000 meters in Phase 3. The plan (budgeted at $32 million) will test a number of parallel targets to the west of the Kay Mine, as well as potential north and south expansions.

Arizona Metals CEO Marc Pais said in a press release: “Drilling results reported today continue to demonstrate the potential for expansion of the Kay mine deposit itself and that it could become part of a much larger mineralization system. In January, it was announced that VMS mineralization intersected approximately 300 meters north of the Kay mine deposit. At the central target, located 500 meters west of the silica mine deposit, all holes intersected by the electromagnetic anomaly encountered anomalous zinc and graphite mineralization.

This style of mineralization is thought to be consistent with mineralization distal to major volcanic hydrothermal vents. Support for this model was obtained from the intersecting hole KM-23-105 at 2.7 m at 0.5% CuEq, 600 m north of the central EM anomaly and 400 m west of the Kay mine deposit (see Fig. 2). The presence of this mineralization indicates increasing access to hydrothermal vents. The 600 meters between the central target EM anomaly and hole KM-23-105 is considered very likely for extensive sulfide mineralization, and numerous drill holes have been drilled to test this area. I am planning. We are also pleased to report that drilling of the first hole at the western target is currently underway and we are now targeting the second hole in the region. A downhole electromagnetic survey of the first hole will begin shortly. “

Here are the highlights of the results:

Recent drilling at the Camine deposits has focused primarily on step-out holes to investigate the extent of mineralization.

Hole KM-22-97

- 8.8 m @ 4.8% CuEq and 1.5 m @ 1.3% CuEq

- Along the near-central northern edge of the deposit, this hole extends mineralization to 100 m north of hole KM-22-71A, with high mineralization 160 m between holes KM-20-11 and KM. We confirmed the vertical continuity of . -21-19.

Hole KM-22-98

- Three intervals including 4.6 m @ 0.8% CuEq and 4.3 m @ 0.9% CuEq

- Drilling from Pad 1 to the central upper part of the deposit has elevated mineralization by approximately 65 m in the gap between the upper north and upper south parts.

Hole KM-22-99

- 9.6 m @ 0.6% CuEq and 3.0 m @ 0.9% CuEq

- A step-out hole along the northern edge of the deposit. Along with hole KM-22-97, mineralization extends approximately 160 m north of hole KM-22-71A in the upper central portion of the deposit.

Hole KM-22-63B

- 1.5 µm @ 0.5% CuEq

- North of KM-22-63D, deep deposit

Hole KM-22-94

- Three intercepts: 17.7 m @ 0.7% CuEq, 3.2 m @ 1.1% CuEq, and 1.3 m @ 0.8% CuEq.

- It is a deep sediment step-out hole along the northern margin located 33m north of hole KM-21-27 and 55m north of hole KM-22-57B.

Hole KM-22-94A

- Several intercepts including 10.4 m @ 1.2% CuEq and 3.4 m @ 2.1% CuEq.

- This hole is about 60 m below KM-22-94, demonstrating continuity between it and hole KM-21-51B.

Kay North Extension

Hole KM-22-80

- Two spacings: 5.6 m @ 0.9% CuEq, 3.0 m @ 0.5% CuEq

- Drilling east from Pad 6, north of the main silica mine deposits. These intercepts lie deep within the footwall of the sediment and are the easternmost intercepts. This suggests the possibility of other deeper horizons or complex folding.

Hall KM-22-91

- 1.8 µm @ 1.1% CuEq

- Drilling east from Pad 6. A mineralized zone extends approximately 150 m north of KM-22-87 located along the northern edge of the drilled mineralized zone.

central target

Hole KM-22-95

- 2.7 m @ 0.5% CuEq from 432.8 m downhole. This is a mineralized intercept in the new area: 600 m north along strike from the northern edge of the central EM anomaly and 500 m west of the other drill intercepts in the Pad 4 area.

- Drilling northwest from Pad 4, testing for strong soil anomalies

- The mineralization is relatively Zn-rich (0.22% Cu, 0.12 g/t Au, 0.61% Zn) and is clearly distal. It lies stratigraphically below the eastern margin of the central anticline, about 10 to 20 m downhole of the mafic-felsic contact.

- This interval indicates mineralization along the future horizon far away from other known mineralizations.

Kay Mine Project Phase 2 Drill Program Update

With the analyzed holes announced today, the company has completed a total of 79,600 meters at the Kay Mine Project since drilling began. The Company has sufficient funding to complete the remaining 3,800 meters planned for the Phase 2 program, prioritizing areas for future drilling (see Figure 1 above) and the upcoming Phase 3 program. with an additional 76,000 meters currently planned for

table 1. This news release announces the results of the Phase 2 drilling program at the Cay Mine Project in Yavapai County, Arizona.

The true width of mineralization is estimated to be 50% to 99% of the reported core width, with an average of 76%. (2) Assumptions used in U.S. dollars to calculate metal equivalents for copper and gold are $4.63/lb for copper, $1937/ounce for gold, $25/ounce for silver, $1.78/lb for zinc, $1.78/lb for lead, was $1.02/lb. Estimated metal recovery (rec.) based on preliminary review of historical data by SRK and ProcessIQ1, was 93% copper, 92% zinc, 90% lead, 72% silver, and 70% gold. The following formula was used to calculate the copper equivalent: (72% rec.) + (zinc (%) x 0.3844)(93% rec.) + (lead (%) x 0.2203)(93% rec.). The following formula was used to calculate gold equivalent: AuEq = gold (g/t)(72% rec.) + (copper (%) x 1.638)(93% rec.) + (silver (g /t) x 0.01291) (72% rec.) + (zinc (%) x 0.6299)(93% rec.) + (lead (%) x 0.3609)(93% rec.). Analyzed metal equivalent calculations are reported for illustrative purposes only. The metals selected for reporting on an equivalent basis are those that contribute the most to dollar value after considering assumed recoveries.

Table 2. Full results of the Phase 2 drill program at the Cay Mine deposit in Yavapai County, Arizona.

The true width of mineralization is estimated to be 50% to 99% of the reported core width, with an average of 76%. (2) Assumptions used in U.S. dollars to calculate metal equivalents for copper and gold are $4.63/lb for copper, $1937/ounce for gold, $25/ounce for silver, $1.78/lb for zinc, $1.78/lb for lead, was $1.02/lb. Estimated metal recovery (rec.) based on preliminary review of historical data by SRK and ProcessIQ2, was 93% copper, 92% zinc, 90% lead, 72% silver, and 70% gold. The following formula was used to calculate the copper equivalent: (72% rec.) + (zinc (%) x 0.3844)(93% rec.) + (lead (%) x 0.2203)(93% rec.). The following formula was used to calculate gold equivalent: AuEq = gold (g/t)(72% rec.) + (copper (%) x 1.638)(93% rec.) + (silver (g /t) x 0.01291) (72% rec.) + (zinc (%) x 0.6299)(93% rec.) + (lead (%) x 0.3609)(93% rec.). Analyzed metal equivalent calculations are reported for illustrative purposes only. The metals selected for reporting on an equivalent basis are those that contribute the most to dollar value after considering assumed recoveries.

Table 3. Full results to date of the Phase 2 drilling program at the Cay Mine deposit in Yavapai County, Arizona. See Table 2 for width and metal equivalence.

Table 4. Results from the Phase 1 drilling program at the Cay Mine deposit in Yavapai County, Arizona. The true width of mineralization is estimated to be 50% to 99% of the reported core width, with an average of 80%.