Southern California lawmakers representing the Eton and Palisades fire zones introduced the bill in Congress on Thursday, giving homeowners affected by natural disasters across the country a break from mortgage payments for nearly a year.

The bill introduced by U.S. Rep. Judy Chew (D-Montapark) and Brad Sherman Oaks requires lenders to grant a six-month suspension on homeowners’ mortgage payments that can document evidence of damage or destruction to their property. Payments will be suspended without interest, penalties or fees, but are not permitted.

The suspension, known as a mortgage evacuation, applies only to federally supported loans in areas where the president has signed the Federal Disaster Declaration, said Chu, representing Altadena. Borrowers have the option to extend their tolerance to extend the lifespan of their loans for an additional six months if necessary.

“They’ve lost their homes, they’ve lived with friends for the rest of their lives, they’ve either covered their hotel bills with their insurance companies or applied to FEMA. Now their mortgage is due too.” “So it’s like paying rent or a mortgage twice. Some of them find it very difficult.”

Non-federal lenders are not required by law to provide tolerance to homeowners in disaster zones, but they often do so. Chu’s office said the bill would standardize federal lenders’ tolerance policies.

After the January fire, it destroyed more than 13,500 buildings in Altadena, Pallisad in the Pacific Ocean and Malibu. Over 400 lenders It provided homeowners with a 90-day suspension of mortgage payments without reporting that they missed payments to the credit agency.

Those who survived the fire said, “You shouldn’t have to worry about missing out on mortgage payments while you’re worried about dealing with so many other things.”

The bill has 11 other co-sponsors, including all Democrats, including Southern California’s Laura Friedman (D-Glendale), Jimmy Gomez (D-Los Angeles), Linda T. Sanchez (D-Whittier), Loulea (D-Santa Ana), and several representatives of representatives due to disasters, such as Repaluielan in Hawaii’s Repaluielan.

Although Republican lawmakers have never signed it as former co-sponsors, Chu and Sherman said they hope the bill will receive bipartisan support.

“This is the smallest thing they can do,” Sherman said. “This is virtually no cost to anyone.”

Chu said the bill was partly inspired by the stories read on the Pasadena Star News, with as many as 3,200 survivors of Eton Fire and Palisade Fire reporting up to 3,200 survivors. I missed my mortgage payment After the January shooting.

The cited story Report by insurance company As a result, on-time mortgage payments in the Pallisard fire area fell 23.9% from December to February and 16.7% in the Eton Fire Area. On-time payments rose 0.2% statewide over the same period.

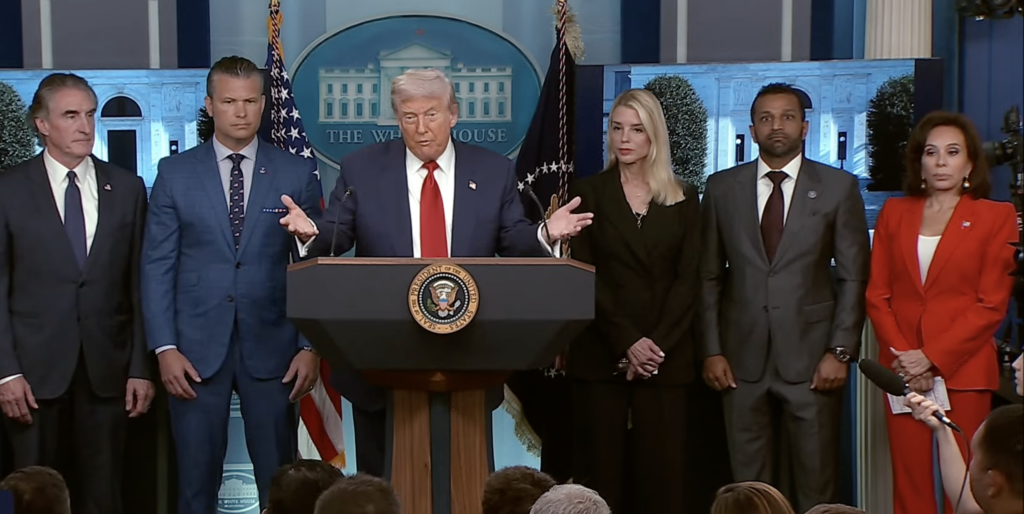

Chu said the disaster bill comes after a mortgage tolerance clause included in the CARES Act, a $2-2 trillion pandemic stimulus package that brought Congress to bipartisan support and was signed into law by President Trump in March 2020.

The CARES Act required lenders to allow for leniency for 180 days of monthly mortgage payments, with a possible 180-day extension.

Last month, Chu and Sherman asked the federal housing finance agency regulating mortgage giants Fannie Mae and Freddie Mac to allow mortgage lenders to grant a suspension of up to two years in a six-month increment after a natural disaster.

The current one-year limit states, “it doesn’t explain the long-term confusion homeowners face after a disaster of this magnitude. By allowing less periods of time with management hurdles, we can help prevent unnecessary foreclosures, maintain homeowners and support community revitalization.”