Tennessee’s cuts to business taxes shift the burden to sales tax income

Tennessee experienced a significant drop in business tax revenues, exceeding $721 million between 2024 and 2025. This decline follows two years of corporate tax credits, putting added strain on the state’s sales tax to bolster its budget. The federal government reduced franchise and excise taxes substantially in 2023 and 2024. As a result, corporate tax […]

Coconino County Proposes New Increases to Property Taxes

Coconino County Property Tax Increases Proposed for 2026 Coconino County has put forward plans for property tax increases in fiscal year 2026 across four areas: the county itself, the Flood Management District, the Library District, and the Public Health Services District. For instance, a property valued at $732,000 according to Zillow has a full cash […]

Alabama’s reduction in grocery taxes is positive, but legislators need to complete the task.

Starting September 1st, families in Alabama will benefit from a reduction in grocery sales tax. The state tax will drop from 3% to 2%, continuing the rollback that began in 2023. This change will also lift the previous limits affecting some counties and local governments regarding the local share of the grocery tax. While a […]

Arizona Voters to Decide on the Country’s First Protection Against Vehicle Mileage Taxes

Rethinking the Relationship with Cars The so-called “war on cars” is becoming more apparent all over the country. Whether it’s in New York with its new pricing schemes or the growing presence of road diets and protected bike lanes, it seems challenging to navigate without feeling the consequences of driving a personal vehicle. Despite the […]

Tennessee and local governments will waive sales taxes on a $4.5 billion nuclear plant

Tennessee’s Nuclear Energy Developments Spark Debate In June 2025, Governor Bill Lee visited Paris and met with officials from Orano. The company had previously announced in September 2024 its intention to establish a multi-billion dollar uranium enrichment facility in Oak Ridge. Tennessee officials had initially welcomed the contracts for uranium enrichment facilities in 2024, but […]

While your senators discuss budget cuts, remember what your taxes have funded in public broadcasting.

Taxpayer support for National Public Radio (NPR) and Public Broadcasting Service (PBS) might be at risk after recent developments in a recovery package proposed by Senate President Donald Trump on Tuesday night. The Senate passed the measure with a narrow 51-50 vote, featuring Vice President JD Vance casting the deciding vote. The specifics of how […]

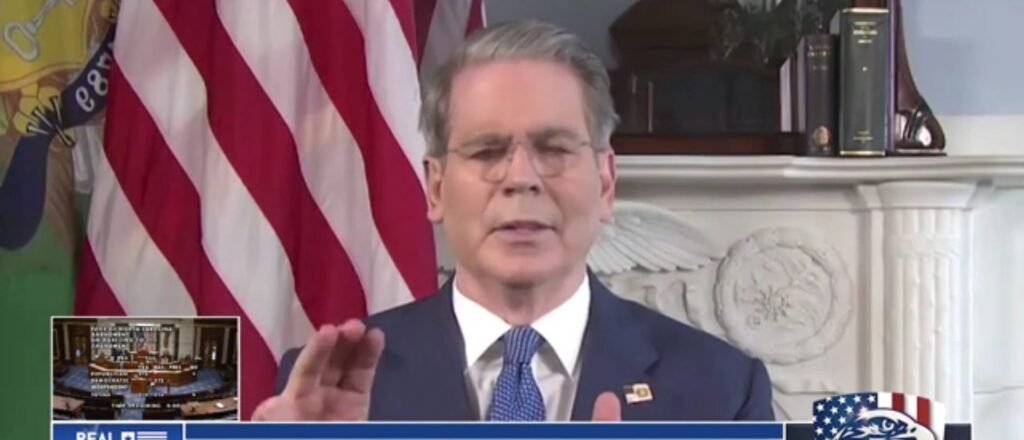

‘Steady Taxes, Affordable Energy’: Scott Bessent Explains to Bannon How the US Will Turn into the ‘Top Place for Investment’

Transforming the U.S. into a Top Capital Destination Treasury Secretary Scott Bescent shared insights on Wednesday about how tax certainty, affordable energy, and reduced regulations could elevate the United States as a premier capital destination. During his appearance on Bannon’s Warroom, Bescent anticipated an economic surge comparable to the post-World War II growth. He highlighted […]

No taxes on overtime: House Republicans support Trump’s tax proposal

Overtime Tax Cuts Featured in GOP Budget Proposal In a recent budget and tax bill released by US Republicans, one of President Donald Trump’s key priorities has been included: there’s no tax on overtime payments. The bill outlines various tax cuts, with certain deductions set to expire by the end of 2028. Trump expressed his […]

State GOP Lawmakers Move To Slice Taxes While Dems Raise Theirs

State Republican lawmakers across the country have introduced and codified laws to cut taxes and facilitate government spending. Since the November election, state Republicans have established reforms that cut income taxes, ease property taxes, and save taxpayers money. In contrast, some blue state Democrats are moving forward with laws that increase property taxes and fees […]

IRS plan to give data to ICE could wallop California, where many immigrants pay taxes

One after the other in recent weeks, Maria’s accounting clients raised the same horror. “I heard that from everyone,” said the 40-year-old consultant of an undocumented small business entrepreneur in Southern California. “They came to me and they said, ‘Hey, should I pay my taxes this year? Because they’re coming to find me.” Maria asked […]