WILFORD: Voters Can’t Afford To Overlook The Fate Of Trump’s Tax Cuts And Job Act

As November approaches, voters’ minds are filled with a variety of issues. Some of the central issues in this election can be directly influenced by the president and members of Congress, while others are not. The irony is that relatively little attention has been paid to one of the most important issues that will affect […]

WILFORD: The Debate Was Devoid Of One Of America’s Most Pressing Issues — National Debt

Whoever wins the 2024 election will have a thankless task ahead of them: figuring out how to get through an extension of a tax cut bill that no one is willing to throw out the window in its entirety, while keeping in mind a looming and growing national debt crisis. This task is hard enough […]

WILFORD: SALT Advocates’ Latest Unconvincing Angle

A small but vocal group of lawmakers in the House of Representatives continues to push for higher limits on state and local tax (SALT) deductions. However, the only changes to the SALT deduction that should be discussed should be reductions, not increases. The SALT deduction allows taxpayers to deduct certain taxes paid to state and […]

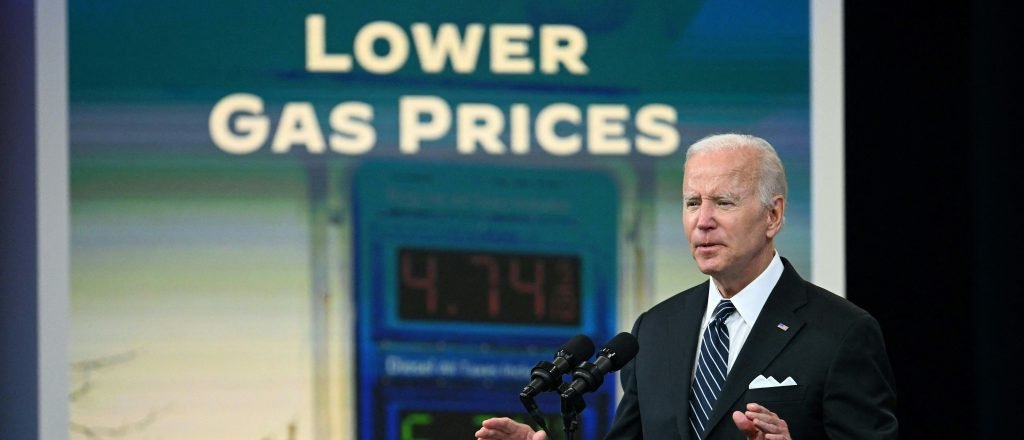

WILFORD: Americans Continue To Have Worryingly Bad Ideas About Price Controls

It's comforting to imagine that a terrible idea will be tossed into the dustbin of history after it proves to be terrible. Unfortunately, the willingness of many Americans to embrace price controls as a solution to inflation proves that this is not the case. Inflation is It's gotten noticeably cooler lately.But many Americans still see […]

WILFORD: The IRS Wants To Remove The Only Thing Standing Between Agents And Taxpayers

Congress last year secured a significant increase in the IRS’s enforcement budget over concerns about how those funds would be spent on backseat taxpayers. Proponents of ever-increasing IRS enforcement funds are quick to assure compliant taxpayers that they have nothing to worry about, but those assurances are betrayed by IRS actions. The $80 billion budget […]

WILFORD: Congress Must Cut The ‘Untouchable’ Programs To Reduce The Debt

Conservatives didn’t get everything they wanted from the debt ceiling bill, but they got something very important. It was the first meaningful deficit reduction in exchange for raising the debt ceiling since 2011. But unless Congress follows through on this first step, taxpayers could reap the benefits. The deficit reduction effect of the agreement was […]