Senator Josh Hawley Moves Forward on Stock Trading Ban

Missouri Senator Josh Hawley is receiving some recognition lately for advancing his Congressional No Share Trade Commission bill from committee to the Senate floor.

Notably, all Democrats on the committee supported the legislation.

This bill is aimed at banning members of Congress, the future president, the vice president, and their spouses from trading or holding individual stocks while in office. It seems pretty necessary given the reports we’ve seen about lawmakers significantly increasing their wealth during their time in office, despite a salary of $174,000 a year. And, well, former House Speaker Nancy Pelosi stands out as a prime example, with a household net worth reportedly over $400 million—quite a leap since her arrival in politics.

When the news broke about a lawsuit involving Visa, investors lost around $30 billion. Interestingly, individuals like Pelosi, who were well-connected, managed to ride it out without much impact.

So, one might wonder how Paul knew the right time to sell his stock? It’s a good question. There isn’t a clear answer here, but it’s likely that this is why Hawley is pushing his own bill.

Unfortunately, there are critics out there who push back against the bill, even though the risks of allowing lawmakers with insider knowledge to trade stocks seem apparent.

One critic insinuated that Hawley’s stance veers towards a populist viewpoint akin to Bernie Sanders, targeting wealth negatively.

Florida Senator Rick Scott remarked on this, questioning when making money became a negative trait in the U.S. He pointed out that it seems Hawley suggests anyone who profits should not serve.

Wisconsin Senator Ron Johnson also criticized Hawley’s proposal, arguing that it may deter the very people who could contribute positively to government from participating.

While their objections are worth noting, they seem misplaced. James Madison once asserted that wealth shouldn’t be a qualification for office. Still, he acknowledged that wealth could attract capable individuals to public service.

Historically, Thomas Jefferson advocated for education and property reforms to ensure that both wealth and political influence resided with those he called the “natural nobility”—those with talent and integrity.

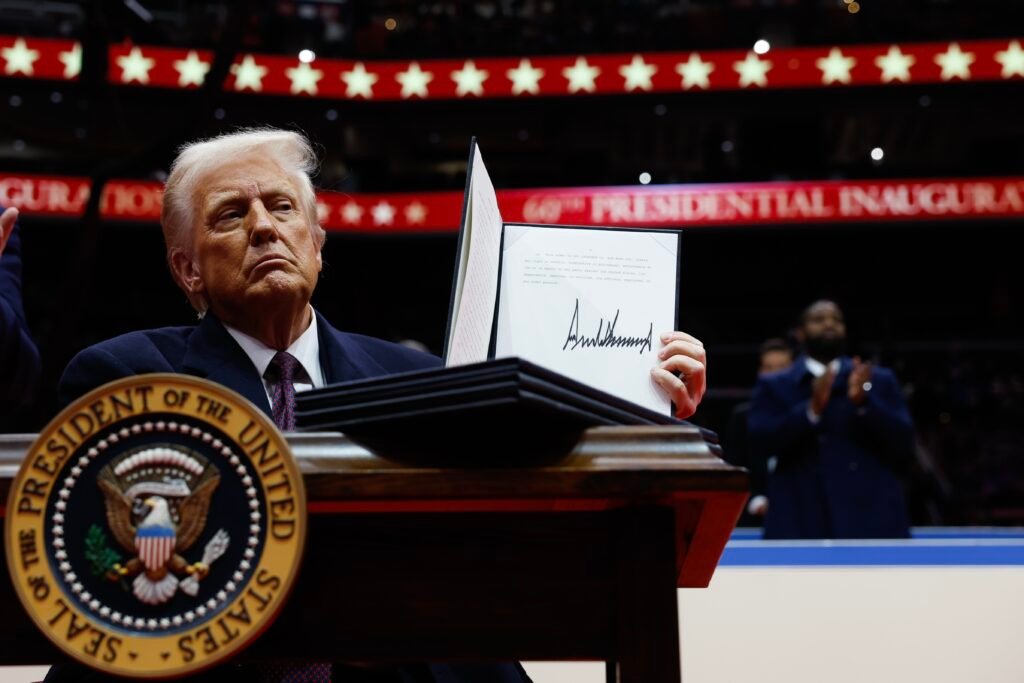

It’s true that wealthy Americans can often make effective leaders. Just look at former President Trump; his net worth certainly surpasses all prior presidents combined.

Nevertheless, Madison advocated for representatives whose insights and abilities rose above local biases and injustices.

Allowing individual stock trading can lead to the very “scheme of fraud” Madison cautioned against, placing lawmakers’ personal interests at odds with the common good.

This raises a significant question about the necessity of forbidding stock trading. A lawmaker might think they can turn a $10 million investment into $20 million through insider trading during their term. But investing in Treasury bills might yield a more modest return—around $750,000 over two years.

A 7.5% return isn’t significantly better, but it’s a safer path. I’m not exactly asking these folks to endure hardships, after all.

Anyone entering Congress with motives tied to personal wealth should rethink their aspirations. Public service ought to involve sacrifice, not a straightforward path to riches.