The Mojave County Assessor’s Office is ready for 2023.

It’s this time of year that reminds us of the wonderful program we offer in the jury room.

Waiver program: Widow/Widower, 100% Disabled, and Newly Disabled Veteran. For information about these popular programs, please visit our office or give us a call. There are certain qualifications required to be accepted into the program. For example, eligible income may not exceed $36,077 per household or $43,733 per household with minor children. There is a property appraisal limit of $29,418. Apply today to see if you qualify. This can result in significant tax discounts. Don’t miss the 2023 application period, which ends on February 28th.

Advanced rating protection: Our Senior Freeze program freezes your value (no tax freeze) so your value will remain the same in the future. Eligibility includes age – at least one of the homeowners must be 65 or older at the time of application – and the property must be the taxpayer’s primary residence . For individual owners she has an income limit of $43,872 and for two or more owners she has an income limit of $54,840.

New address protection program: We are pleased to announce the implementation of a new program designed to reduce potential fraud related to mailing addresses.

This new program began because many taxpayers approached assessors to increase the security of their property titles. Research has shown that most scams start with a change of address. The rating agency wanted to ensure that only property owners could change their mailing address. We have implemented a new program that allows taxpayers to submit a notarized affidavit and request that they be the only authorized agent to change the mailing address of their property. Once the notarized affidavit is filed, the address can only be changed by her second notarized affidavit stating the new address. The program does not completely “lock” addresses. Certain legal processes are required to override the lock. Transfers of deeds, death certificates, judgments, and other legal proceedings void locks.

Once flagged parcels are enrolled in the AAPP program, our office will be forced to contact you for any future changes or transfer deeds. The program was not designed as a fail-safe method to prevent fraud, but it should at least provide concerned taxpayers with an additional level of security to maintain their address and ownership records.

To apply for the AAPP program, please visit one of the evaluator offices listed below. There is a nominal fee of $50 and must be notarized. We have a notary on staff. We hope this program will be successful in increasing the security of your property and the Mojave County Assessor’s Office.

– Bullhead City Hall, 1130 Hancock Road, City of Bullhead, Arizona, 86442 – 928-758-0701.

– Kingman Offices, 700 W. Beale St., Kingman Arizona – 928-753-0703.

– Lake Havasu City Office, 2001 College Drive, Suite 93, Lake Havasu City, Arizona – 928-453-0702.

The evaluator’s office is working hard to keep up with the crazy market we’ve experienced here in Mojave County. The 2022 market has not only resulted in a significant increase in value, but has also significantly increased sales throughout Mojave County. We have already experienced flattening in sales, and we expect these high values to flatten somewhat in future evaluation years.

At our Lake Havasu City office, we are proud to have newly designed office spaces with an ADA compliant customer service area, an executive office for raters, a work space for raters and a break room. Mojave County has done a great job with all the work. Not only did they transform the jury space, but they were also able to simultaneously create a new office space for District 5 Supervisor Ron Gould right down the hall.

As a note to the Secretary of the Treasury, I would like to inform everyone that our annual tax lien sale will run from February 3rd through February 18th. https://bit.ly/3QGf7Og.

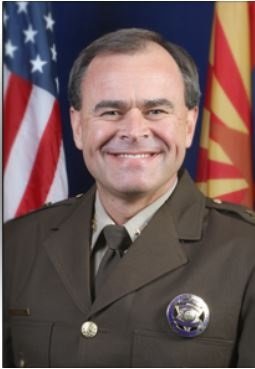

(Gene Kench is an Assessor for Mojave County.)