- The Biden administration and the media claim the economy is strong, touting significant job gains and falling inflation.

- However, consumers are unenthusiastic about the economy, weighed down by the effects of prolonged high inflation, and are uncertain about its future.

- Researcher Jay Kedia said: “Many economists are predicting a 'soft landing' and future predictions may look promising, but that doesn't mean the average consumer is currently paying less for everyday goods. “It cannot compensate for the fact that the amount is significantly higher than in 2021.” for the Cato Institute's Center for Finance and Financial Alternatives, he told the Daily Caller News Foundation.

Experts told the Daily Caller News Foundation that it is natural for consumers to be dissatisfied with the current state of the economy, even as U.S. government officials and the media tout a strong economy.

Consumer sentiment, which measures Americans' perceptions of the economy, is expected to improve in December after hitting a mid-month index point of 69.7 points, although this is far from the month-on-month rate. expensive Biden's approval rating in April 2021 was 88.3, moving further away from the 90-100 range that was common during the Trump era. according to Contributed to University of Michigan Consumer Research. politician And that media have claimed that While they say consumers are wrong to be unenthusiastic about the current state of the economy, experts told DCNF that their perceptions are more in line with the country's true situation. (Related article: Biden's dream of canceling student loans is a nightmare for average Americans, experts say)

“It would be unfair to completely ignore consumer sentiment concerns,” Jay Kedia, a researcher at the Cato Institute's Center for Monetary and Financial Alternatives, told DCNF. “It's true that the 'misery index' (the sum of the unemployment and inflation rates) is low, but consumers are looking forward as well as backwards. “Inflation is low now, so consumers should be happy. ” simply confuses falling inflation with falling prices. Consumers have already suffered from nearly two years of rising prices, and it is understandable that they feel their standard of living has declined since the pandemic. ”

The unemployment rate, which has remained at historic lows since falling to less than 4% under the Trump administration, spiked again in the wake of the initial shock of the COVID-19 pandemic, then fell again. according to to the Federal Reserve Bank of St. Louis. Next, the misery index is I refused Although inflation has slowed in recent months, it remains above pre-pandemic trends.

Inflation peaked at 9.1% in June 2022 under the Biden administration, and has slowly receded to its current 3.1% year-over-year rate as of November. As of November, prices have risen a total of 17.2% since Biden took office in January 2021, with goods such as housing and cars increasing the most.

“After 40 years of relative price stability, the return to significant inflation has left many Americans in financial shock,” said Peter Earle, an economist at the National Bureau of Economic Research. told DCNF. “It is a process that is unfamiliar to the American public, where prices across the economy rise significantly and people feel their own purchasing power waning in less than a year. Although inflation has declined since the 1990s, the general price level is still rising faster than in recent decades.Although the rapid rise in prices has slowed, most Americans 's incomes have not kept up and, as a result, are struggling to maintain their consumption patterns.

Wages have failed to keep up with the sky-high inflation seen under the Biden administration, declining 2.1% since the president took office in January 2021. according to To Fred. To make up the difference, consumers will turn to credit cards to cover their daily expenses, resulting in the amount of credit card debt held by Americans to exceed $1 trillion for the first time in 2023.

“I think what we're seeing right now is a soft landing,” Yellen said on CNN. pic.twitter.com/vkSpN14wHX

— Win Smart, CFA (@WinfieldSmart) January 5, 2024

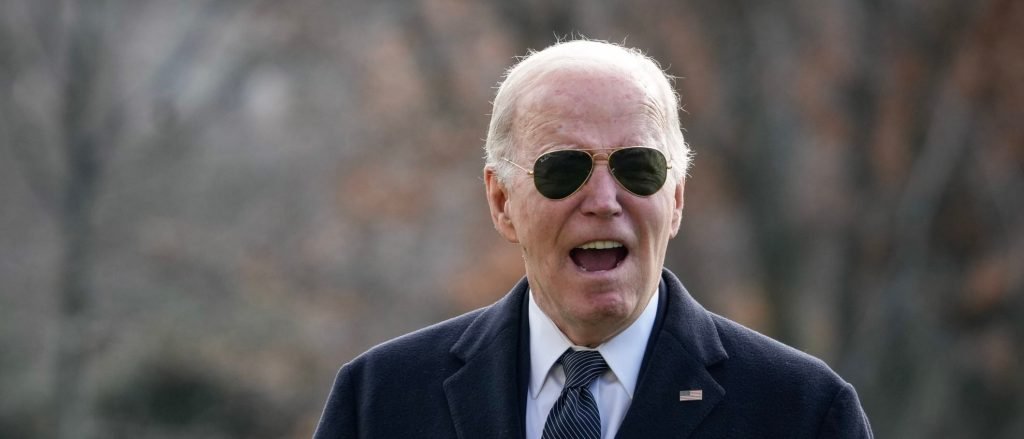

Despite the struggles of American consumers, Biden has maintained that Americans are doing well economically. saying “2023 was a great year for American workers,” he said Friday, pointing to December data showing 2.7 million new jobs were added that year. Jobs created in 2023 were highly concentrated in just a few industries, including government, where total employment reached a record high of 23 million in December.

“Not only is inflation still about 30% higher than it has been in nearly 40 years, but interest rates are also rising at the fastest rate in decades,” Earl told DCNF. “Credit card interest rates are at an all-time high, mortgage rates have not been as high as they have been in over a decade, car down payments and monthly payments are double what they were five years ago, and… Go. The sudden spike in prices and interest rates has strained the personal finances of many Americans, making them more uncertain than ever about the future. On top of that, this is definitely a contentious US election year. And there are also some smaller regional conflicts, so yeah, there's not a lot of optimism.”

The average interest rate on a 30-year mortgage reached a recent peak of 7.79% on October 26, 2023, the highest since 2000, but has since declined slightly to 6.62% as of January 4. ing. according to To Fred. Home prices rose 4.8% year-on-year that month, the highest in U.S. history.

Interest rates are rising as the Federal Reserve Board of Governors (FRB) has set the federal funds rate at a range of 5.25% to 5.50% from July 2023, the highest level in 22 years, in an effort to curb inflation. I feel pressure. The Fed released its median forecast for the future at its December Federal Open Markets meeting, with members saying interest rates could be cut to 4.6% by the end of 2024, providing some relief to debt-strapped Americans. I predict that.

“The potential for a recession is clearly having an impact on the economy. Americans are becoming increasingly reluctant to change jobs,” Earl told DCNF. “The 'employment rate' has fallen to its lowest level since September 2020, as uncertainty about the direction of the U.S. economy is being met by clinging to every form of economic certainty that can be managed. People are losing confidence in taking or finding a new job that pays better than their current job. ”

The number of people voluntarily quitting their jobs continued to decline in December as Americans grew wary of a possible recession. according to To Fred. The number of job separations fell to 3.471 million in November, after retreating from a peak of 4.501 million in November 2021.

“Under President Biden, the economy created 2.7 million jobs last year, more than in any year under the previous administration, inflation fell to 2% in the past six months, and wages and wealth rose below pre-pandemic levels. prices are also rising,” said assistant Michael Kikukawa. a White House press secretary told DCNF. “While there is still much work to do to reduce costs, building on efforts to reduce prescription drug and energy costs, Americans are feeling the effects of a strong economy and consumer sentiment has improved over the past month. It rose 14%, the largest single-month increase in more than a decade. ”

Recession forecasts remain mixed among economists and financial institutions, with Deutsche Bank and Société Générale predicting a recession in 2024, while Goldman Sachs and JPMorgan Chase predict a recession in the new year. We only predict that there is a risk of setbacks. Treasury Secretary Janet Yellen on Friday emphasized the health of the economy, saying the United States had achieved a “soft landing” by avoiding recession and reducing inflation. according to Go to Yahoo Finance.

Kedia told DCNF, “While future predictions may look promising, with many economists predicting a 'soft landing,' it does not mean that the average consumer is currently spending more on everyday items than in 2021. “It doesn't make up for the fact that they're paying a lot more.”

All content produced by the Daily Caller News Foundation, an independent, nonpartisan news distribution service, is available free of charge to legitimate news publishers with large audiences. All republished articles must include our logo, reporter byline, and DCNF affiliation. If you have any questions about our guidelines or partnering with us, please contact us at licensing@dailycallernewsfoundation.org.