Cochise County's new tax rules: Impact and controversy.

As the new year dawns, businesses in Cochise County, Arizona are grappling with a new half-cent transaction privilege tax (TPT). Although TPT is often mistaken for a sales tax, it is actually a tax levied on businesses for the privilege of doing business within the state. The tax increase was narrowly approved in the last election and goes into effect on January 1st.

Full introduction of new tax system

The new tax rates are broadly applicable and affect various business classifications. These include utilities, telecommunications, retail sales, and a variety of other services. Marijuana-related classifications, increasing the county's total tax rate on those sectors to 6.6 percent. However, certain classifications may have different tax rates. The transient lodging and online lodging market was 6.55 percent, non-metallic mining was 3.75 percent, and the new jet fuel excise tax was pegged at $3.66 per gallon. If the main contractor wishes to take advantage of his previous tax rate of 6.1%, he must meet certain conditions.

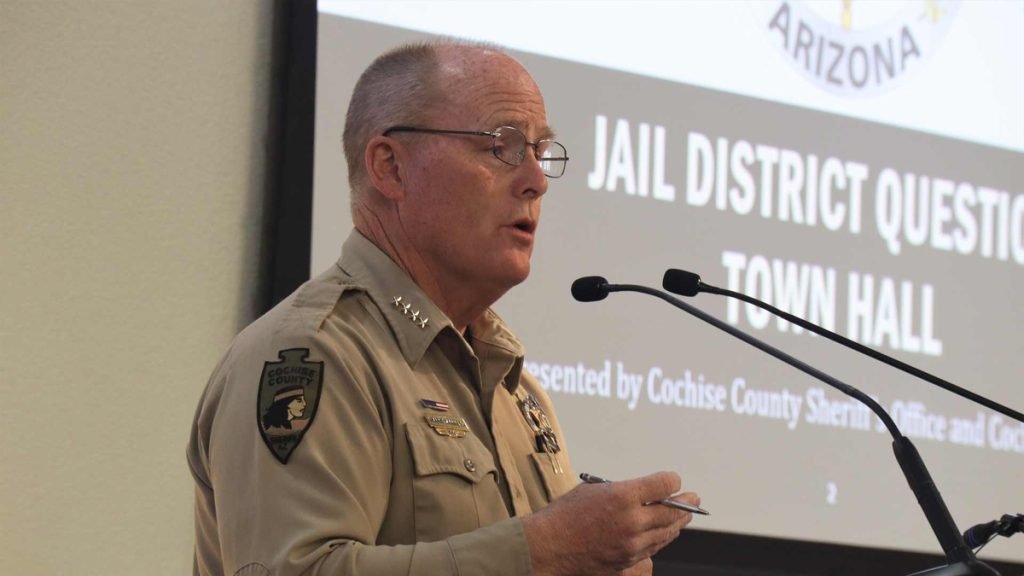

Legal challenges to taxes

But the new tax is not without controversy. He is currently being investigated in court on suspicion of election fraud. Those challenging the election must submit an opening statement stating the reasons for invalidating the election results by February 2nd.

Impact on Arizona families

Meanwhile, Arizona Department of Revenue officials announced that the Arizona family tax rebate will be exempt from Arizona income tax but will be subject to federal income tax. The one-time payments of up to $750 announced by Gov. Katie Hobbs are expected to affect about 750,000 households in the state. These households were already grappling with the economic impact of inflation and are now trying to navigate the new tax landscape.