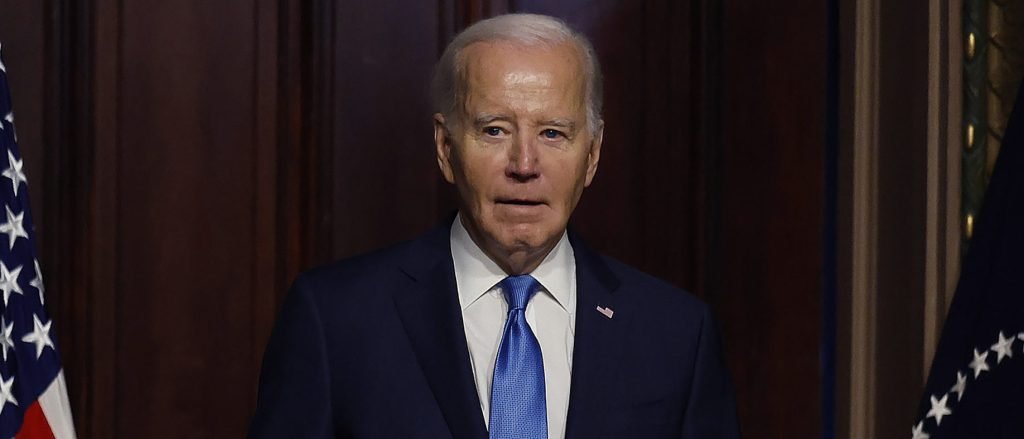

President Joe Biden continues to push for student loan forgiveness for millions of borrowers, but his efforts are having a negative impact on already struggling Americans, experts tell Daily Caller・Told the News Foundation.

Ministry of Education I forgave Added an additional $4.8 billion in student loan debt to 80,300 borrowers in December as part of the Income-Based Forgiveness and Public Service Loan Forgiveness programs, bringing the total forgiven by the Biden administration to $132 billion. It became. Biden's student loan forgiveness policy and resumption of payments will have a negative impact on Americans' discretionary income, the affordability of higher education, taxpayers, personal financial responsibility, and the national debt, according to experts interviewed by DCNF. right. (Related: Americans' finances will take a hit in 2023 amid persistent inflation and high interest rates)

“So a lot of the benefits are concentrated and the costs are spread out,” Adam Kissel, a visiting fellow at the Heritage Foundation's Education Policy Center, told DCNF. “Thus, costs spread across 100 million tax-paying voters will be spread across generations through the national debt, while relatively small but large sums of money will be spread across more serious and will immediately impact a small number of Americans.”

Biden's original student loan cancellation plan, which was struck down by the Supreme Court in June, was estimated to cost taxpayers more than $1 trillion over 10 years, not including subsidized costs from school hikes. , further increasing the already huge federal debt burden. U.S. sovereign debt exceeded $34 trillion for the first time in history on December 29, 2023, increasing the proportion of taxpayer funds dedicated to debt service.

“The other broader context is that Biden's high inflation has canceled out much of the impact of the loan cancellation program on people's lives,” Kissel told DCNF. “And because each person's situation is unique, it will have different outcomes for everyone.Many people are not adequately prepared for resuming student loan repayments, but this is a failure of financial education. be.”

The average student loan payment is estimated to be nearly $300 per month, making up a significant portion of Americans' disposable income. according to Go to US News & World Report. Prices for everyday items have soared due to factors such as rising prices, which have increased by more than 17% since Biden took office in January 2021, and higher interest rates following the Federal Reserve's interest rate hike.

After the Supreme Court rejected Biden's original student loan forgiveness plan, the White House announced New measures including suspension of credit ratings related to student loan forgiveness. Missed payments will not negatively impact a borrower's credit score until September 30, 2024, and the loan will not be considered delinquent, in default, or sent to a debt collection agency until then.

“If I were a lender, I wouldn't trust credit institutions this year,” Kissel told DCNF. “So instead, I ask potential borrowers directly, 'Are you paying off your student loans?'” That tells you something about the potential borrower. In other words, the Department of Education is ruining the credibility of credit reporting agencies through no fault of their own. ”

Borrowers are taking advantage of the moratorium, and nearly 40% of student loan holders, or 8.8 million people, will be behind on their payments by October 2023, after the student loan moratorium ends. October's numbers contrast with the same month in 2019, when only 26% of borrowers missed payments by the middle of the month following their due date.

Through a variety of actions, my administration canceled student debt for 3.6 million people and delivered the promise of higher education to more hard-working Americans.

And we will continue to do so.

— President Biden (@POTUS) January 2, 2024

“Because colleges are not burdened by student loans, any move by the federal government to make college tuition more affordable allows colleges to raise tuition in a general way,” Kissel said. told DCNF. “So every student loan forgiveness program comes with the unintended consequence of education subsidies, making education more expensive.”

Many argue that subsidizing student loans allows higher education institutions to increase their own tuition rates. Researchers at the New York Federal Reserve found that for every dollar of credit aid the government gives in the form of subsidized loans, each institution's tuition increases by 60 cents, and unsubsidized loans increase by 15 cents. I concluded. according to According to a 2015 study.

“Parents are already willing to save and sacrifice to pay for their children's college,” Ryan Young, senior economist at the Institute for Competitive Enterprise, told DCNF. “Student loans are not going to change this, and universities know it. Raise prices by about the same amount as student loan subsidies, and families will continue to save and sacrifice, and pay about the same amount as they do now.” You’re going to keep paying.”

Ministry of Education Spent It contributed about $200 billion to the Office of Federal Student Aid in fiscal year 2023, far more than any other division of the agency. In second place was the Department of Elementary and Secondary Education, which received only $27.75 billion.

“Student loan delinquency rates will rise significantly because many borrowers are not adequately prepared for student loan resumption,” Kissel told DCNF. “We may not have good access to these numbers for a while because the authorities are not reporting them to the credit bureaus, but the numbers will continue to rise.”

Delinquency transition rates rose in every category except student loans in the third quarter of 2023, as more Americans turned to debt to make ends meet. Many Americans rely on credit card debt to make ends meet, which will exceed $1 trillion for the first time in 2023.

“The more student loan subsidies we have, the stronger this effect becomes,” Young told DCNF. “This is great for universities that want to build aquatic centers and hire more administrators. But it doesn't save families money. In fact, the tax increases required for student loan forgiveness , families will end up paying more taxes.”

The White House did not immediately respond to a request for comment from DCNF.

All content produced by the Daily Caller News Foundation, an independent, nonpartisan news distribution service, is available free of charge to legitimate news publishers with large audiences. All republished articles must include our logo, reporter byline, and DCNF affiliation. If you have any questions about our guidelines or partnering with us, please contact us at licensing@dailycallernewsfoundation.org.