Share This Article Paywall Free.

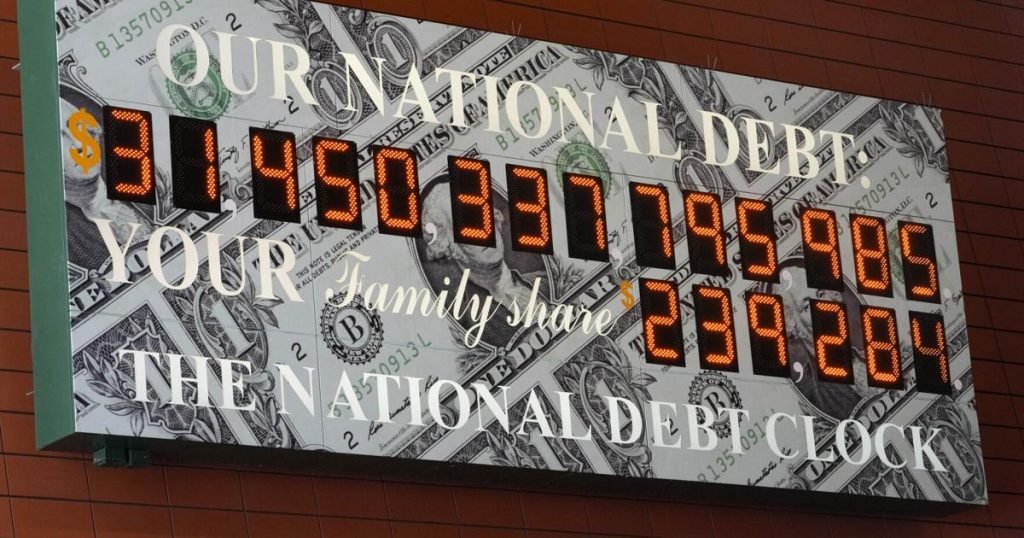

The U.S. could default on its debt starting June 1 if lawmakers failed to reach a deal to raise the debt ceiling.

Had the U.S. government failed to pay its bills, there would certainly have been local repercussions.

That’s why this topic came up at this week’s Coconino County Board of Supervisors meeting. Vice-President Jeronimo Vázquez said he hoped “calm thoughts would prevail” and that a deal would be reached in Washington soon.

An agreement was reached on Saturday evening, so he was up to something.

Coconino County Treasurer Sarah Benatar was also monitoring the situation.

Coconino County Treasurer Sarah Benatar was elected president of the Arizona County Association.

Jake Bacon, Daily Sun, Arizona

For nine years, she has effectively served as president of the county bank. Her office handles county investments, collects taxes, and processes payroll for county employees.

Others are reading…

“I now spend most of my day reading the news, studying, conversing, trying to figure out what the impact is here, and minimizing and mitigating potential risks to the county. We spend a lot of time outlining how to do that,” Benatar said. “Any risk has a cost and we are raising money from the General Fund, which is the tax of the people. How do we make sure taxpayers are protected? How are we protecting voters?”

‘Who am I going to bank?’ Coconino County Treasurer Expresses Concern Over Arizona’s Anti-ESG Bill

Currently, the county has $32 million invested in treasury bills, which are short-term investments with maturities ranging from four weeks to one year. When the bill matures, the federal government pays investors the face value of the bill.

If the federal government were to default, what was once a solid investment for the county could remain unpaid.

“If that happened, how would they deal with it?” [a treasury bill] reach maturity? It looks like they intend to further increase maturity in the future. You just don’t get the interest,” Benatar said.

He said the county is by no means solely dependent on government bonds as far as cash flow is concerned.

“Actually, I have about $50 million in my easily accessible money market accounts alone, which is great. It’s also added to your checking account, so if a major catastrophe hits or you’re meeting your cash flow needs, you’ll be fine,” Benatar said.

Interest rates on government bonds have now risen above 5% as they pose more risk to investors.

“I don’t think I’ve ever seen treasury bills above 5% in four weeks or so. Do you want to buy short-term securities? Probably not,” Benatar said. “This is not a smart move, as it can lead to non-payment.”

Benatar said the consequences would have been “catastrophic” if the federal government hadn’t taken action on Saturday.

US Treasury Secretary Janet Yellen has said that if lawmakers don’t act on the issue, the US will likely be unable to meet its payment obligations after June 1.

Benatar points out that on June 1st, Social Security payments will end and Medicare and Medicaid funds will be distributed. Older people and lower-income groups are likely to have felt the effects first.

“So federal employees are unpaid. For us, that means a lot of unpaid voters. Military personnel are unpaid,” Benatar said. “Then let’s consider that they’re not going to pay the subsidy. If the subsidy payment is going to the county or the state at this point, the ripples will spread. For example, the state receives it.” If I handed it over to the county, the money wouldn’t come in. So what about those services?”

Benatar also said fire season is just around the corner. Many agencies that employ wildland firefighters are federally funded, such as the Bureau of Land Management and the National Park Service.

Prior to Saturday, the debt ceiling was last raised in 2011 after ongoing debate. Congress ultimately voted to raise the national debt ceiling by $2.4 trillion.

In response, the credit rating agency Standard & Poor’s (S&P) downgraded the US credit rating from AAA to AA. In the downgrade, Venter said S&P not only cited the need for the government to develop a more coherent long-term debt management plan, but also said partisan politics made the US more likely to default. It pointed out.

Benatar likens the situation to what ordinary Americans face when they fail to pay their credit cards, except this is happening on a much larger scale and at much higher stakes. . Credit Failure to pay his cards could lower credit scores, raise interest rates, and wreak further havoc on already-stretched household budgets.

“Let’s say they default. S&P announced that they would write the watch negative. They have already said that if they default and fail to pay, we will fire them,” Benatar said. said. “What good does that do for us? That means higher interest rates. On the investment side of the house, that’s always a good thing because you get more income that way. For our entire local economy. And generally speaking, it’s not good, which means it costs more, which means the federal government has to pay more interest.”

Now that an agreement has been reached, salaries and Social Security payments will be paid without interruption to some extent.

Benatar said the country was already very close to a cliff and that even a deal could have consequences.

“What if [these situations] That’s not the reality and we’re starting to reach a situation where the economy is picking up, interest rates are rising and the stock market will take time to settle,” Benatar said. “But we have never defaulted. We are entering uncharted territory.”

Benatar continues to worry that the economy will suffer anyway.

“The closest recent situation was back in 2011. Interest rates were going up for about a year and markets were in a frenzy. If you do, you will end up spending less money, which is bad for your business, and now you will have to pay higher interest rates on debt, and the fees are high. It’s not going to go back to normal overnight,” Benatar said.

Sierra Ferguson can be reached at sierra.ferguson@lee.net.

Get local news delivered to your inbox!

Subscribe to the Daily Headlines newsletter.