The Biden-Harris administration has hidden the economic pain that rising prices are inflicting on Americans and has “significantly” underestimated inflation, according to a new study from the Brownstone Institute.

The Bureau of Labor Statistics’ (BLS) Consumer Price Index (CPI) is one of the most commonly used measures of inflation, but it also includes increased costs of homeownership, economic damage from government regulations, and indirect costs such as health. failure to accurately account for consumer costs of purchasing products. insurance, study Found it. Using an alternative inflation measure to account for these CPI shortfalls, the study authors found that cumulative inflation since 2019 has been underestimated by nearly half, and economic growth has been overestimated by about 15%. found that the US economy is in recession. From 2022. (Related: ‘Recession may have already begun’: Biden administration admits it overestimated employment by nearly 1 million jobs)

“These conclusions stand in stark contrast to the establishment narrative that the U.S. economy is enjoying strong growth that is somehow unrecognizable to the public,” said study author Grover M. Herman of the Heritage Foundation.・E.J. Antoni, a researcher at the center, said: Written for the Federal Budget and by Peter St. Onge, Mark A. Kolokotrones Economic Freedom Fellow at the Heritage Foundation. “Indeed, our results are consistent with the perception of the American public, a majority of whom believe we are in a recession.”

In this study, we quantified some of the biases in inflation statistics to get closer to a true understanding of economic growth from 2019 onwards.

~@RealEJAntoni & @profstonge

Recession after 2022: U.S. economic income and production will decline across the board over four yearshttps://t.co/jj09or5VDB— Brownstone Institute (@brownstoneinst) October 9, 2024

About 70% of respondents say the cost of living is their biggest financial concern. According to This was revealed in a public opinion poll conducted in May by market research and analysis company Harris. However, on paper, the economy is not in a long-term situation. period decline with the economy grow up The growth rate for the second quarter of 2024 has been revised upward to 3%, significantly higher than the 1.6% growth rate in the first quarter.

Antoni and Onge attribute this discrepancy primarily to a “housing-related bias,” arguing that the CPI’s proxy for the cost of owning a home, owner-occupied housing equivalent rent (OER), underestimates inflation. It is claimed that calculated It’s based on rent costs, which have grown more slowly than homeownership costs over the past four years. As a result, the CPI will be ‘significantly underestimated'[ing] Since OER accounts for approximately 26% of CPI, it is considered “housing cost inflation.”

According to Brownstone’s research, another CPI shortfall stems from the difficulty of quantifying the impact of government regulations. If a regulation is increasing the price of a product, but the government claims that the regulation has improved the quality of the product and, as a result, increased the value of the product, no price increase will be recorded and the price will fall. It may be possible to connect.

The CPI also does not take into account price changes that consumers are charged indirectly for goods, the study claims. For example, in the case of health insurance, costs are imputed from the health insurance company’s profits. In other words, if an insurance company’s profits decrease due to an increase in its operating costs, CPI will count that change as a decrease in costs to consumers. The premiums consumers pay and the coverage they receive remain the same as before.

These “egregious biases” cause the CPI to significantly underestimate the price increases that hit ordinary Americans’ wallets, according to the study. Furthermore, the downward adjustment in inflation is not large enough, which causes the “real GDP” growth rate (economic growth adjusted for inflation) to be overestimated.

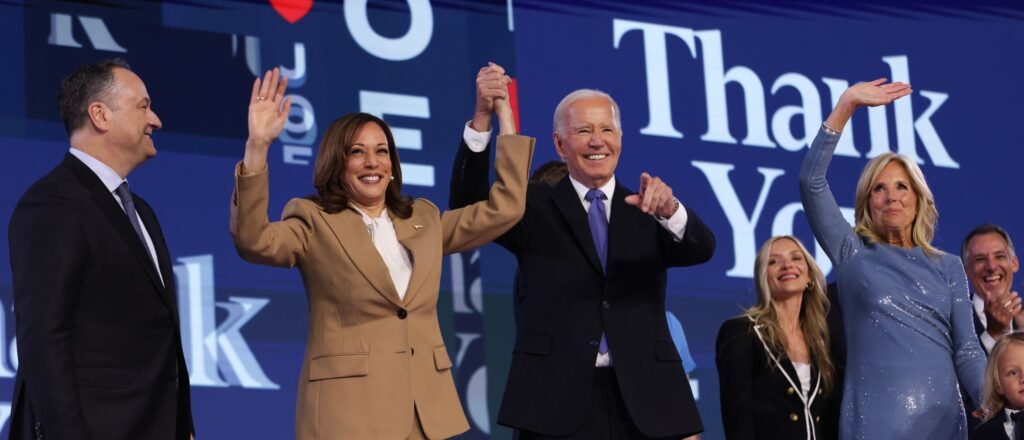

The White House has scored victories on inflation and economic growth in recent months, as the year-over-year CPI approached the Federal Reserve’s 2% target and President Joe Biden claimed in August that he had “healed the economy.” There is.

However, adjusting for deficiencies in the CPI index, adjusted real GDP declined by 2.5% between Q1 2019 and Q2 2024, and the economy declined in the two years from Q2 2022 to Q2 2022. It didn’t really grow. According to research, as of 2024.

The White House did not respond to requests for comment.

All content produced by the Daily Caller News Foundation, an independent, nonpartisan news distribution service, is available free of charge to legitimate news publishers with large audiences. All republished articles must include our logo, reporter byline, and DCNF affiliation. If you have any questions about our guidelines or partnering with us, please contact us at licensing@dailycallernewsfoundation.org.