One of seven bills for Alabama awaiting a vote by the Alabama Senate Finance, Taxation and Education Committee hits a close-to-home issue in the state's low labor force participation rate: child care.

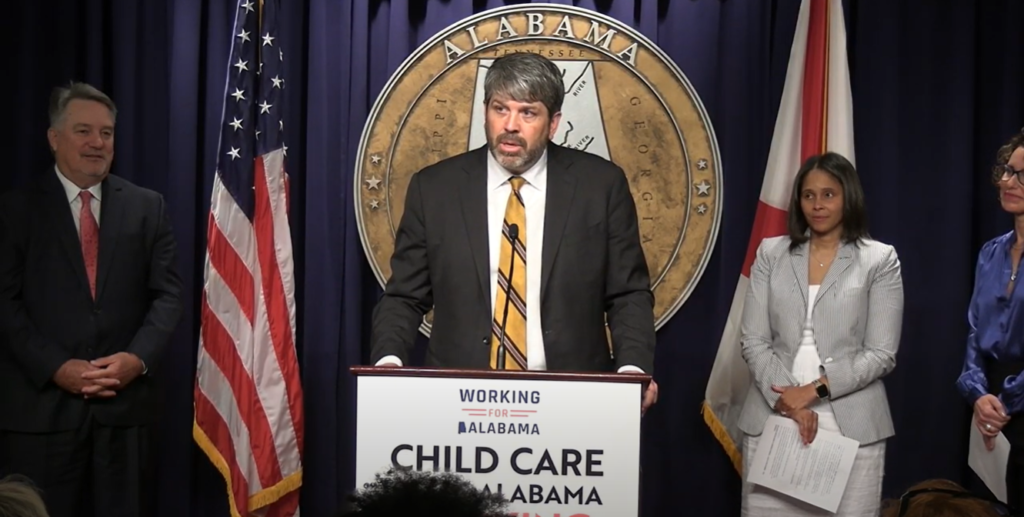

Proponents of the bill, including House Speaker Nathaniel Leadbetter, state Sen. Garlan Gudger, state Rep. Anthony Daniels, Alabama Women's Foundation CEO Melanie Bridgeforth and a representative from Toyota, each touted the benefits and urgency of passing the child care tax credit.

“Even before our current economic challenges, affordable child care and access to quality child care were pressing issues in Alabama in 2022,” said State Senator Gudger. “Approximately 85,000 families across our state found themselves without viable child care options due to staffing shortages, rising prices and concerns about quality.”

“The American economic downturn has only exacerbated this situation, turning Alabama into a so-called child care desert, where working families struggle to find adequate, accessible child care options. In Alabama, parents make up 35 percent of the workforce, and access to high-quality, affordable child care means increased workforce participation and boosted economic growth locally and across the state.”

RELATED: Toyota Alabama President: Alabama's child care tax credit isn't just good for business, it's great for parents too

HB358The bill, which passed unanimously in the Alabama House last week, would include an employer tax credit and child care center subsidy for employers who offer child care at their workplace or allow employees up to $600,000 a year in child care expenses. It would also create a tax credit for child care providers who participate in the state's Child Care Quality Rating Program and for donors to make improvements to nonprofit child care facilities.

House Speaker Nathaniel Leadbetter has been speaking out on workforce issues, child care and other related issues even before lawmakers made them a top priority for a comprehensive workforce package this session.

“I would be remiss if I didn't talk about the committee that we formed to address workforce participation,” said Rep. Ledbetter (R-Rainsville). “And one of the things that we found is that over 43 percent of working-age people in Alabama don't have jobs in the state. We have to try to solve that in order to grow our economy. And one of the things that they identified as being most important is child care.”

“It's staggering. Over 85,000 families in the state need some kind of child care, so it makes sense that women would want to go back to work. But when you're paying $12,000 for child care, that's how much money you're spending, and when you have two kids, it's difficult,” he said. “For a single mom, it's almost impossible.”

Melanie Bridgeforth, CEO of the Alabama Women's Foundation, a group that has steadily raised awareness in the state about the lack of affordable, accessible and quality child care in Alabama, said moving the House-passed tax credit forward in the Alabama Senate is crucial for families — and for voters.

RELATED: Alabama and national leaders develop child care access strategies at Women's Foundation annual research event

“For years, we've been shining a light on one of the most important and critical issues: barriers to workforce participation for women and families. We've organized tens of thousands of women allies, businesses and philanthropists across the state to work on child care issues and many other solutions that impact women's economic mobility and intergenerational economic mobility for families, but it's not our fault,” Bridgeforth said.

“We have people in this building with the power to ensure change. They are your elected officials, and how they vote on the Child Care Tax Credit plan will immediately show us all where they stand among their priorities. Alabama voters, employers, child care providers, mothers and fathers are watching. Members of the House have already demonstrated great leadership and thoughtful leadership. They have now done their part. Now it's up to the Senate to pass House Bill 358 without changes.”

RELATED: Working for Alabama: Lawmakers advance bill to benefit state's workforce, economy

House Minority Leader Anthony Daniels, who introduced the bill in the House, also enthused that the bill finally addresses issues of access, affordability and quality of child care.

“I believe this bill will help these families get back to work. It will also help businesses expand access to child care by allowing them to build facilities on-site or partner with child care providers,” said Rep. Daniels (D-Huntsville).

“And the credit also helps working families earn some money to help pay for child care. So accessibility, affordability is key. And when you look at quality and what it means, the higher the credit, the better. The better the quality, the five-star facilities, the highest reimbursement possible for individuals, which can be paid directly by employer with a check or by individuals directly to the provider.”

Senator Gudger expressed the urgency and need to hammer out a solution across both chambers with five days remaining in the 2024 legislative session.

“Just to let you know, this bill is currently before the Senate. It's expected to be in committee sometime this week. But if you're listening, please call your senators and tell them it's time to take up this bill. It's time to vote,” Gudger said.

Grayson Everett is the state and politics editor for Yellow Hammer News. You can follow him on Twitter. Grayson

Do not miss it! Subscribe now Get the top Alabama news stories delivered to your inbox.